In response to pandemic uncertainty, agents advise international students to hedge their bets

The third round of Navitas Agent Perception Research is most comprehensive to date, capturing opinions of more agents in more countries on the impact of COVID-19 on international education.

In May 2020, Navitas asked its agents to reflect on the relationship between the handling of the coronavirus pandemic by different countries, and the extent to which this made a country a more attractive study destination. We found that countries that had handled the health crisis well (Australia and New Zealand) were perceived to be more attractive study destinations and vice versa.

In September 2020 Navitas repeated its research, finding that governments’ handling of the pandemic had become less of a differentiator for destination countries – Australia and New Zealand had fallen behind while the United Kingdom was the stand-out performer.

The most recent round of agent research, conducted in March 2021, is our most comprehensive sample of agent perception, capturing the views and opinions of nearly 900 agents in 73 countries around the world. The first part of this report revealed that perceptions of Australia and New Zealand have become more entrenched, while the United Kingdom and Canada continue to look poised for a rebound and the US shows signs of a remarkable turnaround.

This is the second part of that report and reveals interesting variations in perception and outlook in different source country regions.

Countries of participating agents

In response to pandemic uncertainty, agents are advising prospective international students to hedge their bets

Agents are primarily advising students to stay the path – study online until travel is possible

Agents play an important and privileged role in guiding international students towards the options that best meet their hopes and dreams for studying abroad. In a time of great complexity and uncertainty, agents arguably fulfil an even more important role in helping students to navigate border closures, visa conditions, shifting modes of delivery, and oscillating prices and foreign exchange rates.

In most countries, face-to-face classes have had to transition to online delivery. For many students, studying online until travel is possible might be considered the next best thing. Other surveys have found that students are broadly accepting of online delivery when it is a short-term, interim measure before face-to-face delivery resumes.

Our experience working with students and their parents over the last twelve months tells us that they are committed to continuing their studies and have a strong preference for face-to-face delivery. The challenge for many agents is convincing parents and students that waiting for borders to open only places them in a longer queue for admission, visas and flights once travel is possible, and therefore commencing online as a transitional measure is in fact a better option.

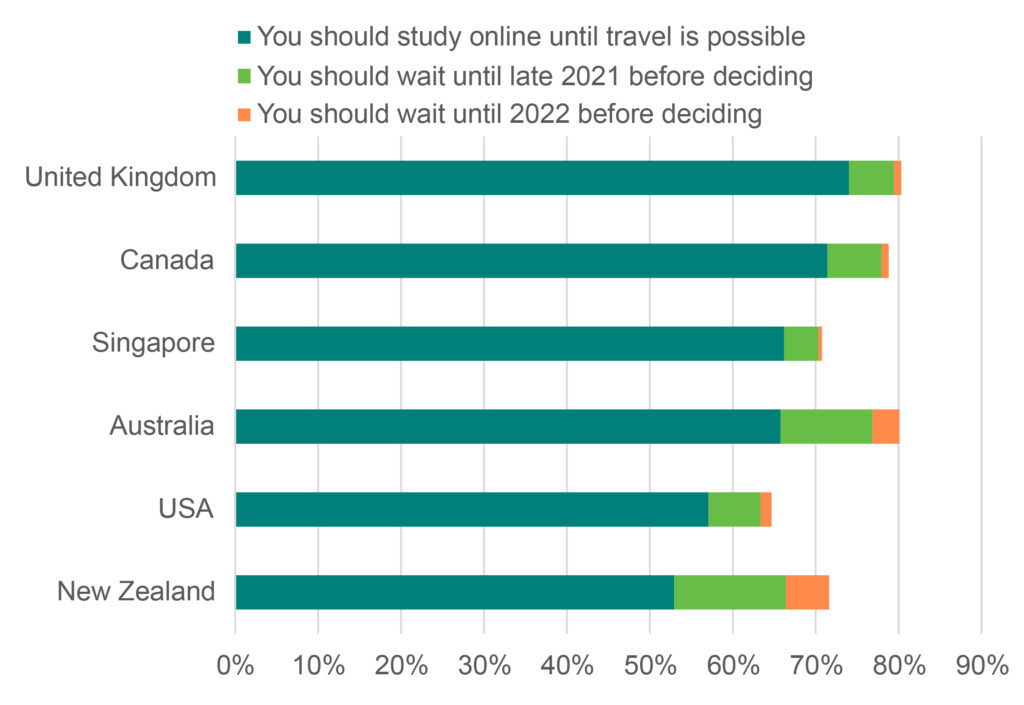

Our research reflects our experience in the market. When we asked the Navitas network of agents, “What would you recommend to a student looking to study in the following destinations if they asked your advice today?” the results confirmedthat the overwhelming majority of agents said that studying online until travel was once again possible tended to be their default recommendation.

The United Kingdom and Canada had the highest proportion of agents stating this was their primary recommendation, which is entirely consistent with the optimism agents reported when asked if travel was going to be likely in the next 6 to 12 months.

Fig 1.1: What would you recommend to a student looking to study in the following destinations if they asked your advice today? Study online or wait.

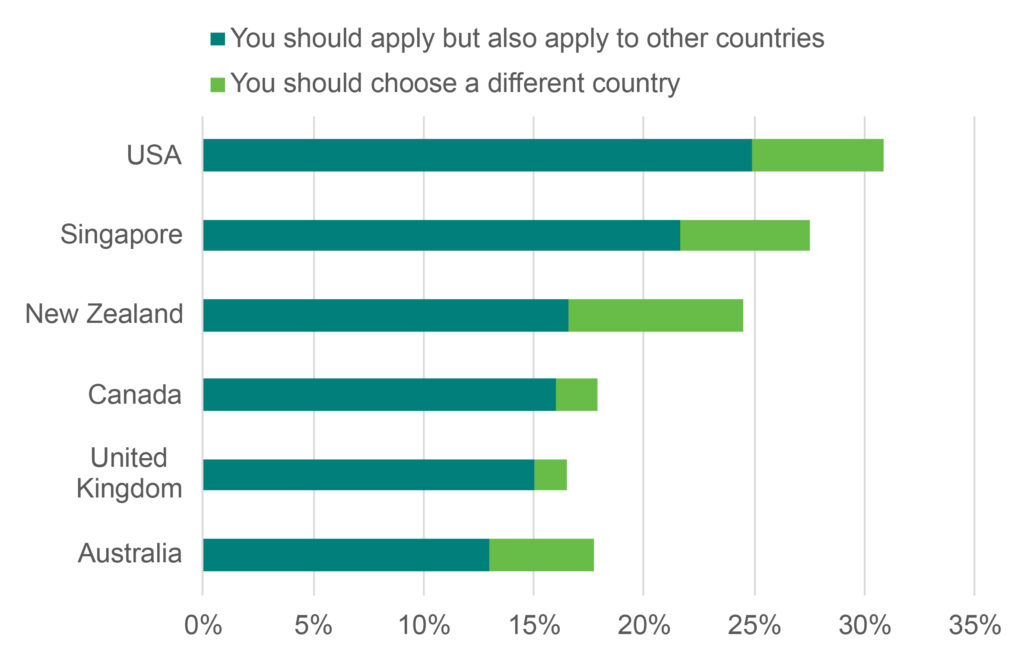

A sizable proportion of agents are recommending students consider the option of a different destination country

There have been various reports pointing to the increased likelihood that students who are unable to fulfil their study plans are looking to switch destinations. Anecdotally, we have often heard that where students used to hedge their bets with multiple “backup” institutions in the same study destination, they are now hedging across multiple countries. The long-running QS survey in particular has shown that from the start of the pandemic through to late 2020, the proportion of students impacted by the pandemic that say they intend to switch has risen steadily month-by-month.

The Navitas agent survey shows that agents themselves are recommending that applicants either apply elsewhere, or at least apply to another destination to hedge their bets. At a minimum, about one-in-six agents (16%) are recommending that applicants to the United Kingdom have a back-up option. This proportion rises to 18% for Canada, 18% for Australia, 25% for New Zealand and 31% for the USA. This represents a substantial proportion of students that are being advised by their agents to switch study destinations, or at least be prepared to switch with backup applications to other countries.

Fig 1.2: What would you recommend to a student looking to study in the following destinations if they asked your advice today? Hedge or apply elsewhere.

“We know that face-to-face remains the priority and focus for most students, so I am not surprised to see that agents are being pragmatic with the advice they offer students. Agents will respond to student preferences and countries with open borders and campuses will undoubtedly benefit. For agents their reputation rests on being able to “solve” these problems for students so being able to offer a number of options in terms of location and destination is now as important as just being able to place the student in the institution of first choice.”

Tony Cullen, EGM Global Engagement

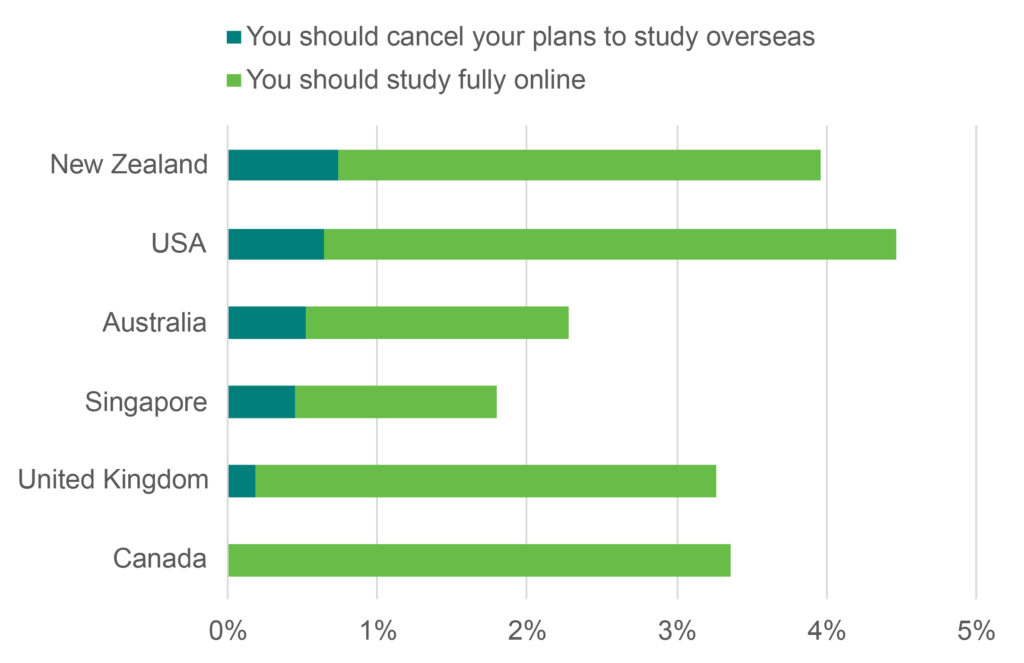

Very few agents recommend either cancelling or studying fully online

Only a small proportion of agents are recommending that students wait before deciding. Unsurprisingly, agents are more likely to recommend that would-be students wait before deciding if those students are looking to study in Australia (12%) and New Zealand (18%). On the one hand this reflects the uncertainty around the closed borders in those two countries, but it could also be interpreted positively, in that agents are not recommending students change their plans entirely.

Consistent with increasingly negative sentiments towards online delivery, very few agents are recommending to students that they cancel their plans to travel and study fully online instead. Also consistent with other surveys that show there is a very low proportion of students that intend to cancel (between 2% and 10% from survey to survey), agents are likewise not recommending cancellations.

Fig 1.3: What would you recommend to a student looking to study in the following destinations if they asked your advice today? Cancel or study online.

At a country level, this results in a fluid environment of shifting market shares. Consistent with prior analysis, there is a large proportion of students that remain not-yet-committed to a given country. Historically, country selection was an important decision made early and resolutely. In the midst of the pandemic, this is clearly no longer the case.

At an institutional level, this underscores the unpredictability of the final decisions that students will make. Until tuition fees are paid and students arrive on campus, it would be prudent not to assume that students will continue through the conversion funnel as they have done in previous years. For as long as would-be students are hedging their bets to mitigate uncertainty and risk, the volume of applications may not reflect intentions, and even the volume of acceptances may not translate into actual enrolments in the same way they historically would.

“At the moment it’s definitely the messaging from destination countries that is driving the decision-making process for both agents and students. Parents and students want to be confident that the receiving country is safe and welcoming, that they will be looked after, that the country has commenced an efficient vaccine rollout plan, and that if they need to quarantine the experience will be a positive one.”

Tony Cullen, EGM Global Engagement