EdTech: A story of global growth and diversification

The higher education sector is grappling with two opposing forces: heightened expectations for learning outcomes, while government funding is constrained. So it’s not surprising technology has moved in to solve some traditional friction points in the process.

However, over the past few years we’ve seen EdTech shift from being seen as siloed ‘over-hyped’ services like MOOCs to value-adding partnerships. Increasingly EdTech provides the tools to help institutions fulfil their mission more effectively, complementing their student offer and expanding access to education.

Through Navitas Ventures, we have shared our observations on this maturing sector by investing in global research such as Project Ecosystem. And we are investing in great ideas, such as our commitment to virtual work experience provider InsideSherpa.

Here’s a snapshot of the global state of play in EdTech.

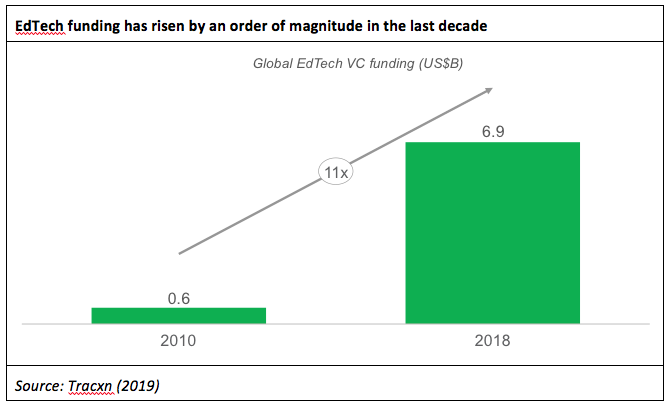

EdTech funding reached record highs in 2018

Over the last 10 years, EdTech has emerged as a distinct sector with its own investors, community, and expertise. Globally we’ve seen a surge in fundraising, especially in major markets such as China and the US.[1] While investment in Chinese tech companies (including EdTech) has slowed in 2019, US EdTech funding continued to grow over the first half of 2019.[2]

The regional and global EdTech community now regularly comes together at events such as ASU-GSV in the US, London EdTech Week, GET in China, and EdTech Asia (Southeast Asia). Accelerators and ecosystem champions such as Emerge Education and EduGrowth are the catalyst for local EdTech growth.

EdTech has become more geographically diverse

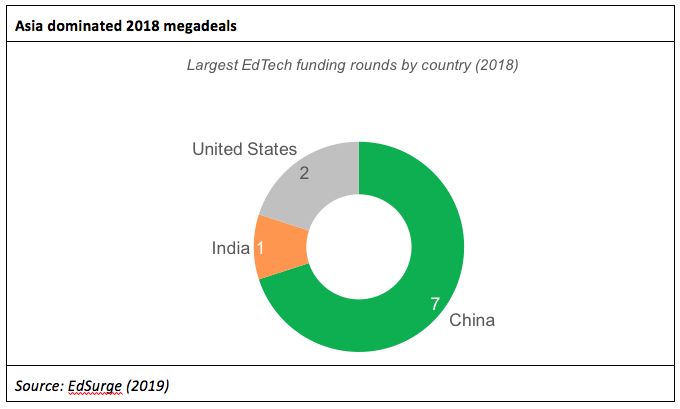

While the US historically dominated the EdTech sector, ‘home-grown’ companies are emerging to respond to very local needs. In large domestic markets such as China and India, they have been able to scale very quickly – and these markets are also highly regulated, protecting them from traditional tech players out of Silicon Valley.

China is home to one of the world’s leading EdTech ecosystems, with an estimated 3,000 EdTech companies in Beijing alone.[3] Many of these are focused on English language learning and K-12 education, such as VIPKid and Yuanfudao. While Chinese companies accounted for most of 2018’s largest rounds of fundraising, this may have reflected the strong market for venture capital financing at the time and the scale opportunities recognised in the China market.

India just generated its first billion-dollar EdTech unicorn. Byju’s is a highly popular educational app aimed at the K-12 and test prep markets. While the broader EdTech ecosystem remains at an early stage[4], a strong household appetite for education and a vibrant tech industry support this country’s potential.

According to recent Navitas Ventures analysis, Southeast Asia is also an emerging region to watch. Vietnam punches above its weight in both education and innovation, and Singapore also benefits from a high rate of tech adoption, a willingness to invest in private education, and a new accelerator to support the emerging ecosystem.

While Europe also has several dedicated EdTech accelerators and established investors such as Emerge Education (UK), Brighteye Ventures (France) and xEDU (Finland), sector funding is not up to recent levels seen in China and the US.[5]

A complementary partner for education providers

Fears that technology will replace the teacher or institution are waning, along with the misguided notion that engagement or use equates to effective learning all by itself.

Instead, established education providers now see the EdTech sector as a potential partner – one that can help them streamline admin, provide a better student experience and ultimately improve student learning outcomes.

For example, MOOCs were once seen as a potential threat to universities. Today three of the four largest English-language MOOC platforms now actively partner with universities to offer online short courses, micro-credentials and degrees.[6] Only Udacity uses its own content, but as a specialist provider of technology-focused short courses rather than a replacement for existing programs.

Georgia State University has also seen the potential for EdTech to solve very specific challenges. It uses data analytics to identify at-risk students and improve retention and graduation rates, as well as chatbots to help incoming students get quick answers to common questions.

It’s important to recognise the majority of EdTechs are founded by education professionals. In other words, by education insiders. They can see the inherent flaws in the current system but want to improve things – not replace them. This is just one more reason why EdTech has grown across so many different markets and channels over recent years. And why understanding its potential requires both a global perspective, and a more nuanced understanding of how EdTech delivers value across education sectors.

[1] Based on several databases: Tracxn (2019), Pitchbook (2019), JMDEdu (2018), EdSurge (2019)

[2] EdSurge (2019)

[3] Navitas Ventures (2018)

[4] Navitas Ventures (2018)

[5] Brighteye Ventures (2019)

[6] By number of registered users, ClassCentral (2018)