Navitas Ventures releases Global EdTech Ecosystems 1.0

When we set out to analyse EdTech environments across the globe – including in cities as diverse as Paris, Cape Town and Tel Aviv – we heard one comment over and over again.

“Five years ago there was no EdTech and now there is a distinct sector.”

Having already mapped the young but rapidly changing EdTech sector in our Global EdTech Landscape 3.0 report, we wanted to create a comprehensive, measurable assessment of how individual cities perform in terms of fostering an effective EdTech environment.

It was an ambitious endeavour with a worthy goal: to foster greater collaboration and global connections across this fast-growing sector. And I’m pleased to say you can now download our first release, Project Ecosystem 1.0, as an interactive tool.

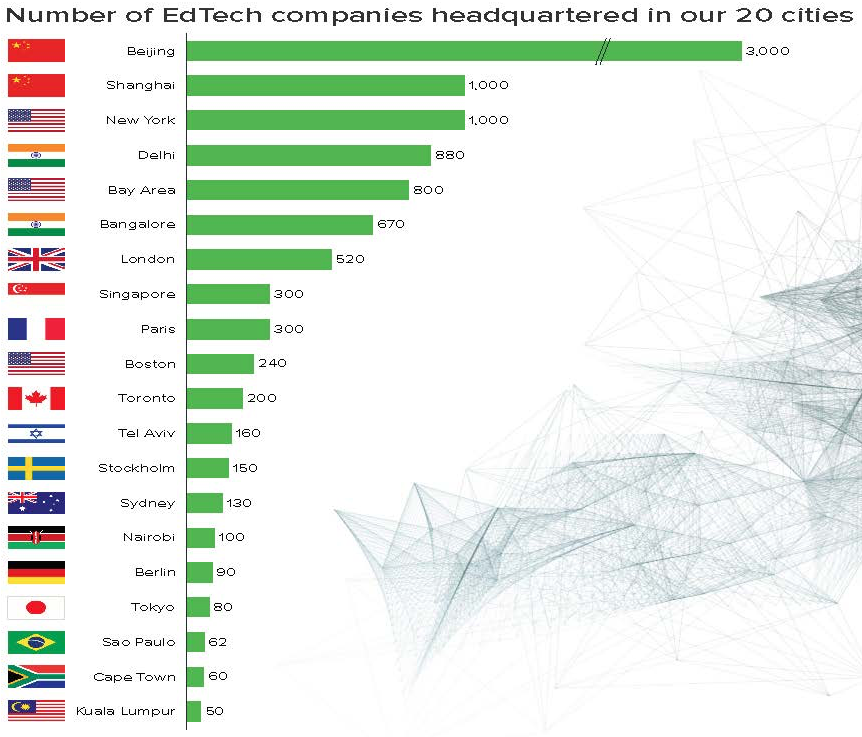

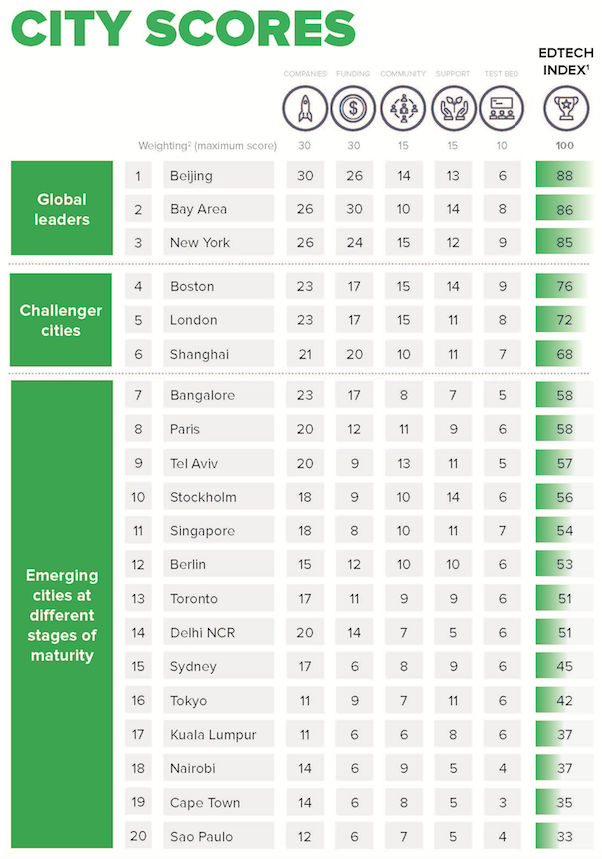

We selected 20 diverse cities, and benchmarked them using a unique EdTech index score to measure their maturity across five key dimensions of a successful EdTech environment:

- Companies – the breadth and depth of the EdTech landscape

- Funding – the availability and sources of EdTech capital

- Community – the maturity of the community, including the availability of incubators

- Support – from government and education providers

- Test bed – the quality, size and accessibility of the local education sector.

These 20 cities are not the necessarily those with the largest EdTech ecosystems. If we’d only focused on those, we would have a fairly narrow field concentrated in the US and China. Instead, we wanted to identify trends across every continent – so we gathered insights from leading EdTech experts in each of our 20 cities, and used these as well as a range of data points to evaluate the weighted performance of each.

The results represent the initiatives of around 25,000 different companies, comprising about 40% of the global EdTech sector.

Here are just a few of the insights we uncovered.

Three cities dominate global EdTech, but for very different reasons

Beijing is number 1, headquartering an unparalleled number of EdTech companies. It dominates EdTech within its domestic market, has the highest concentration of EdTech companies per capita globally and has a strong focus on K-12 education – such as tutoring, test preparation and English language learning.

In contrast, the Bay Area (#2) looks outward, providing global EdTech with seed capital, technical expertise and market access. And New York (#3) demonstrates the value of its impressive self-efficient EdTech ecosystem. Its broad local test bed also helps successful EdTech companies prove their concept – such as General Assembly, Noodle and Codecademy.

All three benefit from strong partnerships with local universities, and New York and Beijing also leverage extensive local government support.

However, EdTech startups certainly do not need a Beijing, Bay Area or New York address to raise capital or succeed.

Emerging EdTech cities draw on their strengths

Boston (#4) and London (#5 and Europe’s EdTech capital) also have highly supportive EdTech ecosystems, including specialist accelerators and strategic investors, and close collaboration with education providers. Cities with fairly traditional education systems – such as Tokyo (#16) and Paris (#8) focus on corporate and lifelong learning, while Singapore (#11) benefits from a holistic, government-led response. We also see cities with relatively small domestic markets set up launchpad offices in larger markets, such as SmartSparrow (Sydney – #15) or Matific (Tel Aviv – #9).

Developing cities are solving their education challenges in exciting ways

Bangalore (#7) has the potential to capture India’s exploding demand for workforce training and alternative education – if it can access more funding and strong support from its education sector. Nairobi (#18) is home to several start-ups using SMS to overcome the lack of classroom computers to deliver teaching content.

The next wave of growth will come through collaboration and capital

One thing the Big Three share is a well-established ecosystem. If emerging EdTech cities want to increase the maturity of their sector, the appointment of an ecosystem champion is an important first step. International and domestic collaboration, and coordinated development, can only happen this way.

Their other advantage is funding. This is the major barrier to growth for EdTech companies outside the US and China – but given the diverse and exciting initiatives we’ve uncovered in Project Ecosystem 1.0, venture capital would do well to look at emerging markets.

Where are the world’s next EdTech breakthroughs?

Download the full report, including profiles of the 20 cities, on our interactive website, and click through the icons to connect with the companies, investors and ecosystem champions who lead the EdTech ecosystem development in their cities.